"Resilience is the capacity to recover quickly from difficulties; toughness. It is the ability to bounce back from adversity and to keep moving forward towards your goals, despite the obstacles in your path"

Yesterday, ECB raised rates by 50 bps as inflation continues to be elevated. Euro area Feb inflation is pretty elevated with inflation running at a hot 8.5%. Acc. to the monetary policy statement, the policy decision will be informed by a data dependent approach which will be guided by three factors:

1. The inflation outlook based on incoming economic and financial data (development in the financial markets, financing, financial cost, terms and conditions and the financing of the economy at large)

2. The dynamics of inflation

3. The strength of monetary policy transmission

On the current banking sector stress, ECB expressed confidence that the euro area banking sector is resilient, with strong capital and liquidity positions and limited exposures to the US institutions. It also assured markets that it is fully equipped to extend liquidity support and preserve smooth transmission of monetary policy.

Growth and Inflation projections:

In the press conference, ECB President Christine Lagarde stated that If the baseline projections was to persist, ECB would have a lot of ground to cover albeit a lot is contingent on the financial data.

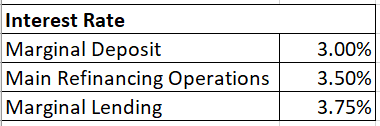

The EURUSD rate after having touched a low of 1.0548 bounced back and is trading higher at 1.0647. The interest rate markets are pricing in 3.70% policy rate by Dec 2023. For USD, the interest rates markets are pricing in interest rate at 4.20% by Dec 23 year. The implied interest rate differential between EUR and USD has further narrowed which is a positive for the EUR. If the current stresses in the banking sector do not snowball, we could see Euro perform relative to the USD. Since Feb 24, EURUSD has been taking support at 1.0520 levels.

That's on the ECB Policy decision. Links to earlier EURUSD posts:

Comments

Post a Comment