“There’s a big difference between probability and outcome. Probable things fail to happen—and improbable things happen—all the time.” That’s one of the most important things you can know about investment risk.” ~ Howard Marks

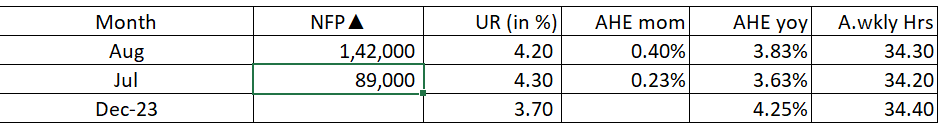

With Fed Chair's Front and Center focus on evolving outlook of the US employment situation, this week carried extra significance and the Employment data catalyzed the move in Yields. Yields on US2s fell 35 bps (High - Low Range) and on US10s 28 bps (High - Low Range) over the week. On US2s Yields, we closed right at 3.65% and on US10s at 3.71% which is in close proximity to the braking point we mentioned earlier in the backdrop of the larger H&S Formation. We did not get the upticks towards the 4.10% handle we were hoping for. Another Trade I had thought about and did not write was the break below the 3.90% - 4.10% consolidation range but that's because consolidation break outs many times chop you out so better to trade at the top of the consolidation where the SL is tight rather than play on break outs.

Whether we follow through on the price action during this week on CPI / PPI release or retrace the move is to be closely watched.

Generally, Monday's tend to be follow throughs of Friday's price action and Tuesday's we get the reversal - just something to be cognizant of.

US2s10s dis-inversion continued through the week with the spread closing at +6.20 bps, levels last seen in July 2022. In the last week blog entry, we spoke about the technical triangle that has a potential target of 15.50 bps on Us2s10s.

Over the week, we only got a 23.6% retracement on the USD move to 101.92 Level from where we reversed and closed the week at 101.19.

The market is pricing in 59% probability of 125 bps of rate cuts as against a 98% probability of 100 bps of rate cuts in 2024. In the next 1 year, cumulative rate cuts priced by the market hold a 74% probability of 250 bps of rate cuts. Which means that softer inflation prints or poor Economic data could push the pricing to 100% probability of 250 bps cuts. For the upcoming 18 September Policy, there stands a 70% probability of 25 bps of rate cuts.

Nick Timiraos of the WSJ writes that the August report was not bad enough to seal a 50 bps rate cut but wasn't good enough to rule it out as well. 1 Option with the Fed would be to cut 50 bps in this policy and another option would be to cut by 25 bps and signal several more cuts when they release the Statement of Economic Projections.

Estimates of Atlanta Fed GDP now stand at 2.10% (40 bps lower from last week). Cleveland Fed Estimates for Core PCE for August and Sep are trending at 0.26% mom and 0.27% mom and 2.8% yoy and 2.7% yoy respectively.

Brent Crude Prices were down 9% on the week and the set up looks very constructive for a much sharper move lower. A monthly H&S formation that has broken below the trendline at 76.50 and closed the week at 71.50.

The data on Jobless Claims is summarized below and not much to write about since IJC is moving around the averages and CJC pulled back from yearly highs of 1860K.

Comments

Post a Comment