Data released on reserves held by depository institutions that were borrowed from the Federal Reserve through the Discount Window (DW), Paycheck Protection Program (PPP) Liquidity Facility (PPPLF), Bank Term Funding Program (BTFP) announced on Mar 12 and other lending facilities show a sharp surge in use of Federal Reserve Facilities.

To put things in perspective, the Primary credit discount window as on 8th March was availed to the extent of USD 4.6 bn which surged to USD 153 bn post the SVB Crisis. If you look at the chart number 1 below, on the left hand side of the chart , you would observe the peak usage before the collapse of SVB Bank to the tune of USD 111 bn as on Oct 29, 2008.

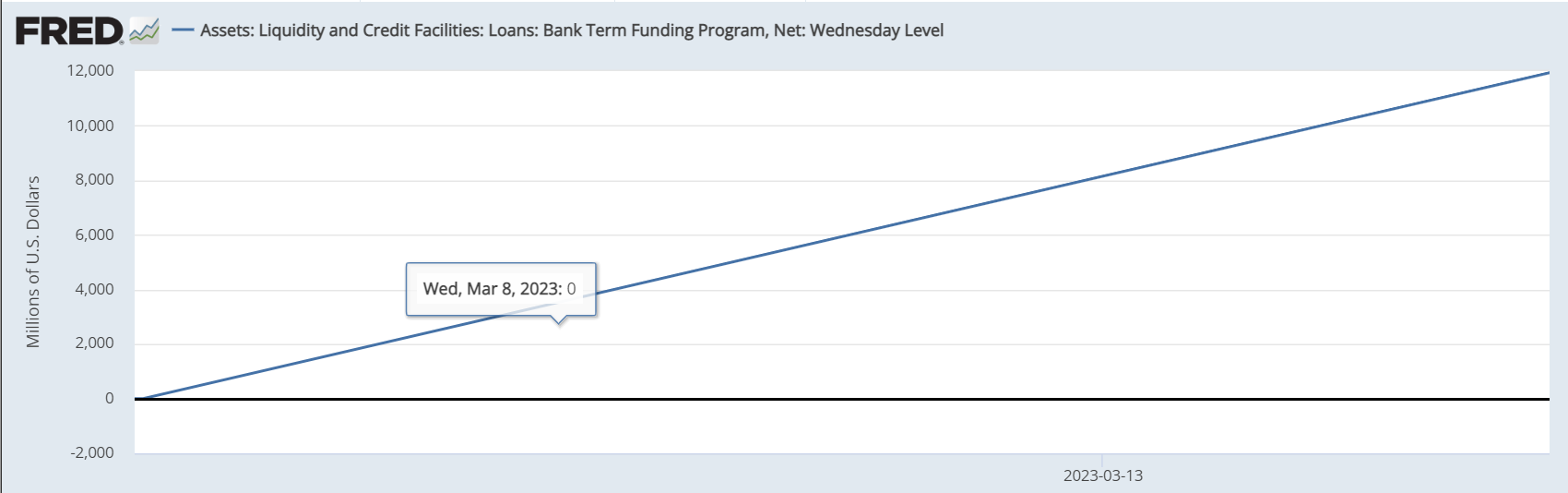

The PPPLF is a covid era measure with nothing home to write about. The BTFP facility which became operational on 13th March 2023 saw usage to the tune of USD 12 bn (Chart 2). Other credit extensions rose from zero as on 08th March 2023 to USD 143 bn in the aftermath of the crisis (Chart 3).

Other credit extensions includes loans that were extended to depository institutions established by the Federal Deposit Insurance Corporation (FDIC). The Federal Reserve Banks' loans to these depository institutions are secured by collateral and the FDIC provides repayment guarantees.

Comments

Post a Comment