"Optimism isn't a belief that things will get automatically get better, it is a conviction that we can make things better"

Hi everyone, so this has been an extremely action packed week both on the domestic data front and global data front. For this article, we will be purely focussing on the EURUSD Trade recommended earlier to sell at 1.0950 with a SL at 1.1000. Unfortunately, we got stopped out of the trade.

What I have realised during the course of trading is to give ourselves some leeway in terms of time for the view to play out. It is also helpful to understand whether a trade is driven by technical considerations or there is a catalyst to drive a pivot in price. If a trade is driven by technical considerations then you wait for the price to consolidate to give you a clear entry and exit point. However, if the trade is driven by a catalyst, then you study the catalyst and dive in.

In this trade, we were driven by technical levels and hypothesis around fundamental factors which had not materialised. Rather I think now, it would have been better to wait for a catalyst for a reversal to put in size or buy some options to express your view.

We did have a catalyst in the week gone by:

1. US Federal Reserve increased the policy repo rate by 25 bps to 4.50% - 4.75%. While the Federal Reserve did continue to emphasise that ongoing rate hikes will be appropriate but the Fed would be more data dependent. Chair Powell also did not push back on the current loosening of financial conditions. He rather commented that Financial conditions have tightened very significantly over the last year. The market pricing of interest rate did not materially change post the policy with market expecting rates to rise to a terminal 4.75% - 5.00% followed by a pivot materializing in 50 bps of rate by end of 2023.

With hawkish expectations from ECB and a dovish message from Fed Chair, EURUSD continued to rally to touch highs of 1.1033. However, post the ECB rate decision which echoed on same lines as the US Federal Reserve decision, EURUSD turned since the policy was not as hawkish as markets were pricing.

2. ECB announced the interest rate decision to hike the deposit facility rate by 50 bps and guided policy towards another 50 bps rate hike in the 16 March 2023 meeting and it will then evaluate the subsequent path of monetary policy. "Keeping interest rates at restrictive levels will over time reduce inflation by dampening demand and will also guard against the risk of a persistent upward shift in inflation expectations. In any event, the Governing Council’s future policy rate decisions will continue to be data-dependent and follow a meeting-by-meeting approach."

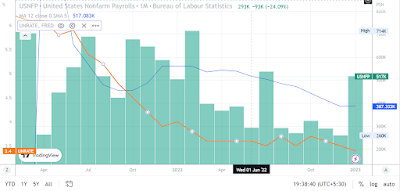

3. Post the ECB announcement, US NFP data pulled the USD higher by its horn. US NFP rose 517K much stronger than consensus estimates of 185K and the unemployment rate dipped lower to 3.40%. The report shifted the interest rate expectations higher with market now pricing in a peak terminal rate of 5.03% and 65 bps of rate cuts by end of 2023. Market believes that the current pace of rate hikes will push the US into recession and the Fed will be forced to cut rates.

Comments

Post a Comment