The U.S Employment Situation Report was released on Friday. Details of the economic release:

1. NFP 311K - above consensus estimate of 205K and following a revision to January number to 504K from 517K. Employment gains in December and January combined were 34,000 lower than previously reported

2. Participation Rate moved higher to 62.50% from previous 62.40%

3. Unemployment Rate moved higher to 3.6% from decadal lows of 3.40%

4. Average hourly Earnings (AHE) rose 0.24% mom with the pace of monthly rise decreasing from previous 0.27%

The report showed strength and the softening in momentum of rise in AHE.

However, the Employment Report coincided with the news of the closure of the Silicon Valley Bank (SVB). SVB is the 16th largest bank in the United States and the largest bank by deposits in Silicon Valley. The pace at which the whole situation unravelled in mindboggling. Closure of SVB Bank comes in quick succession to the closure of Silvergate Bank.

SVB had $ 212 bn of assets with 35% in loans , 7% in cash , 55% in fixed incomes securities. With the boom in the tech industry, SVB deposit book rose exponentially but the loan book ($74 bn) was relatively small as compared to traditional lenders. So SVB invested heavily into low interest bearing Treasury and Agency Securities. The reversal in Federal Reserve's ultraloose monetary policy, was the genesis of the problems for the bank. Fed maintained rates at 0 - 0.25% until Feb 2022 after which is started increasing the rates aggressively (current FFR 4.50% - 4.75%). The situation got compounded as flows which would come to SVB reduced on decline in VC investment activity plus tech slowdown and the cash burn of SVB Clients increased which meant that the deposit flow reduced and outflow increased.

SVB Bank sold its Available for Sale (AFS) securities portfolio to the tune of $ 21bn comprising of US Treasuries and Agency Securities of 3.6 year duration yielding 1.79% and commenced an underwritten public offering, seeking to raise approximately $2.25 billion. As a part of this capital raise, General Atlantic committed to invest $500 million. Media reported that the capital raising plans had failed and that the bank is looking for a buyers triggered a mass exodus of deposits to the tune of $ 42 bn which lead to the bank failure.

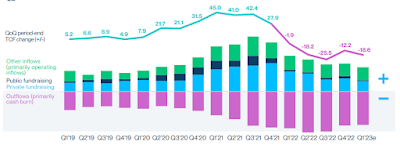

The mid quarter update published on 08th March 23 on SVBs website highlights concerns around slowing VC deployment (15% - 20% decline in VC investment activity) which had the effect of reduced client fund inflows; high client cash burn which was 2X higher than pre-2021 levels, a possible rating downgrade action by Moody's.

|

| US VC Investment steadily declined from a peak of $ 94 bn (end 2021) to Estimates of $ 30 bn in Q1 23 |

The bank closure and the impending uncertainty saw wild moves in the market:

S&P closed below the 3900 mark at 3897. US 2Y Yields dropped sharply to close the week at 4.59% (50 bps fall from the peak 08th March high - 5.0850%) and the US 10Y yield closed the week at 3.70% (down 28 bps from the 08th March high). The USD index initially declined to 104.04 and then recovered off lows to close the week at 104.64. Gold prices closed the week sharply higher at $ 1867.

The Fed Fund Futures repriced interest rates with peak pricing of 5.27% in June 2023 and Dec 2023 pricing shifting materially downwards to 4.88%.

The contagion risk to India of SVB closure is minimal. However, the SVB incident has sparked global risk aversion. Treasury Secretary has denied the possibility of a bank bailout. The next available option is finding a buyer for the bank. Meanwhile, acc. to media sources, it is also being discussed to create a fund that would allow regulators to backstop more deposits at banks that run into trouble following Silicon Valley Bank’s collapse.

Comments

Post a Comment