Current liquidity operations with the RBI

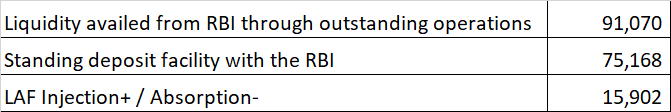

As on 26th Dec 2022, the net LAF injection by RBI stood at 15K crore. Understanding the component wise break up is important here:

The maturity profile of the outstanding operations is as :

RBI stance on liquidity

RBI in the last monetary policy meeting retained the stance towards withdrawal of accommodation. The document stated "RBI remains watchful of evolving liquidity conditions and stands ready to inject liquidity, if required, to meet the productive requirements of the economy. This, however, would be contingent upon a durable turn in the liquidity cycle when banks would move away from holding large balances under the SDF and variable rate reverse repos".

Anticipating the future liquidity trajectory

Variable rate reverse repo stand at 13453 crs maturing on Dec 30, 2022.

Now the liquidity management framework (26 Sep 2019) recommended that the design of the corridor system generally requires system liquidity to be in a small deficit of 0.25%-0.50% of NDTL.

NDTL stands at 178 lac crores. This means that RBI is likely to announce durable liquidity measures as the liquidity deficits expands beyond 44k - 88k crore which is essentially banks turning away from SDF and leaning on MSF.

Outlook for durable liquidity

Durable liquidity stood as on 02nd Dec 2022 stood at 2.96 lac crore. Changes in durable liquidity are on account of only 2 factors - Change in CIC and RBIs intervention in the forex market.

CIC growth in the last quarter averaged 5% over the last 4 years. Dec 16, 2022, CIC stood at 32.41 lac crores. Assuming CIC growth of 5%, durable liquidity could change by 162K crore by the end of the year.

It will be difficult to ascertain the liquidity change on Fx intervention as the USD outlook is highly uncertain.

The durable liquidity surplus is expected to decline in the quarter ahead which means that money market rates would be operating at the upper end of the corridor.

I'm in a little rush and hence unable to write as much as I'd like to on the subject of liquidity. I would be delving deeper into the article in the days ahead.

Comments

Post a Comment