Hi Good morning folks,

"Our life is what our thoughts make it"

We had the release of the much awaited US CPI data. Headline CPI rose 0.10% mom (est 0.30%) and core CPI rose 0.20% mom (est 0.30%). CPI yoy grew at 7.10%. The CPI numbers show a declining trend from the peak of 9.10% in June 2022. The number was lower than the range of estimates. Market is pricing in a terminal rate of 4.835% for the May 23 Fed policy. Peak terminal rate expectations have shifted by a full 42 bps between Nov 4 and today. The expectations are for a 50 bps hike in today's policy ( Dec 14, 2022) and another 50 bps until the May 23 policy with rates peaking between 4.75% - 5.00%.

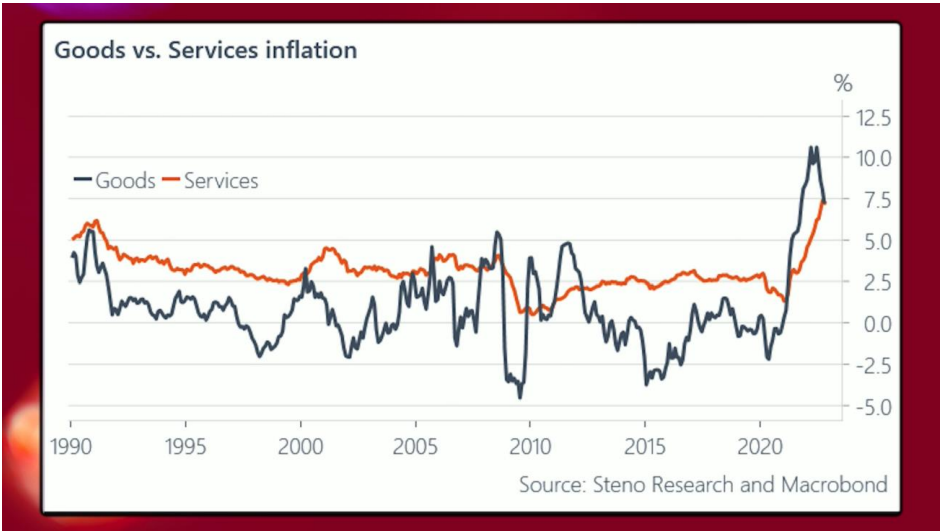

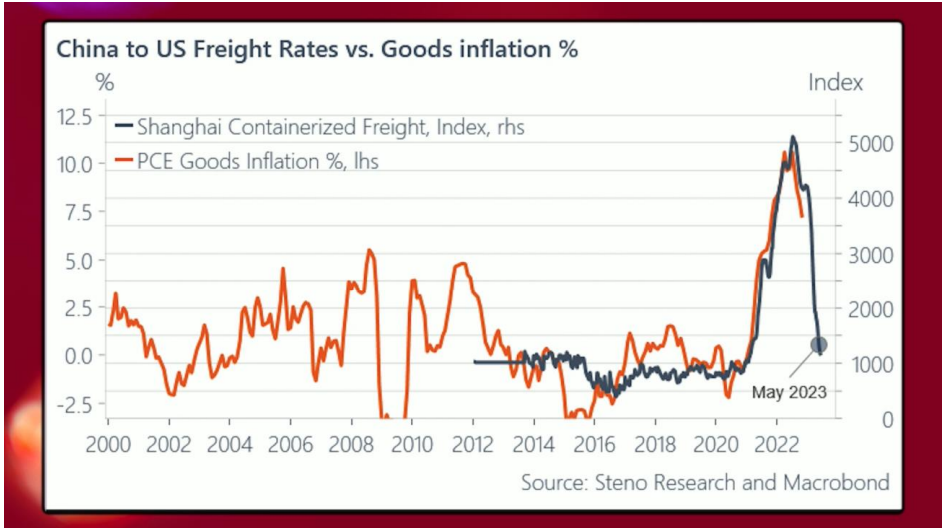

One interesting point about today's CPI print is the divergence between goods and services inflation ( chart below: source RealVision). The goods price inflation is coming off on demand weakness and de-clogging of supply chains. Andreas Larsen of RV points to the strong correlation between China - US Freight Rates and Good inflation; Maheim used car index and CPI used cars and trucks to show trends towards good disinflation. However, the services sector is more wage driven. It is driven by healthcare and education. The steady growth in average hourly earnings (0.60% in Nov 22) and average non farm job gains of 277k for last 4 months, the services component could be sticky and complicate matters for the Federal Reserve.

Comments

Post a Comment