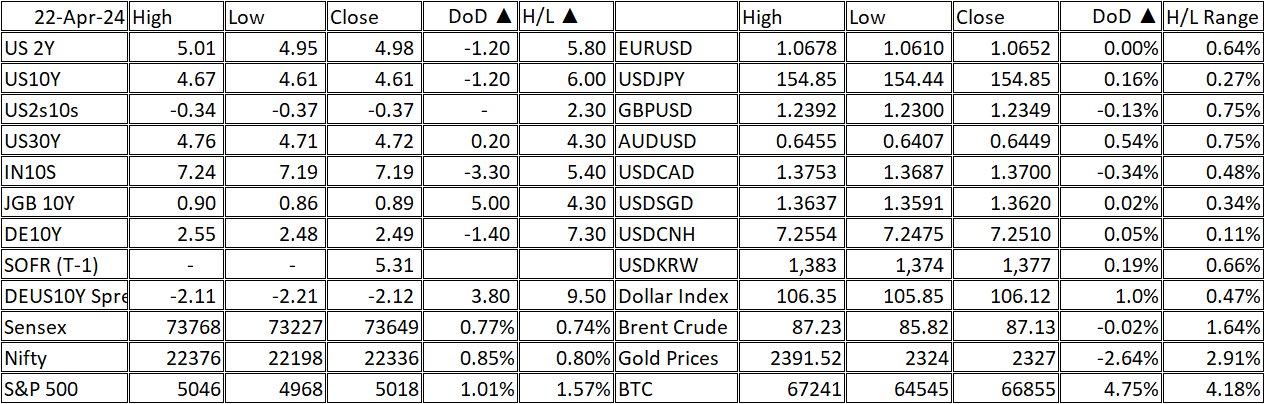

The Market Implied Fed Fund pricing for Interest Rate Cuts by the US Federal Reserve is now seen at 40 bps of rate cuts into 2024 from 38 bps of rate cuts seen yesterday morning. We have sideways consolidation across Bonds and USD index though US Equities made a strong come back and Gold Prices posted a big negative day, an outside day candle after the one day reversal candle seen on Friday. I continue to favor USD Shorts into the 106.45 - 106.75 Levels.

Yields on IN10s also posted a big outside day reversal candle and if the hypothesis about the a turn in USD index is correct and US Yields start moving lower, we would have timed the reversal in IN10s accurately. I am now looking for a pull back into the 7.20% - 7.22% to go long IN10s.

Comments

Post a Comment