"Believe. Think. Visualize"

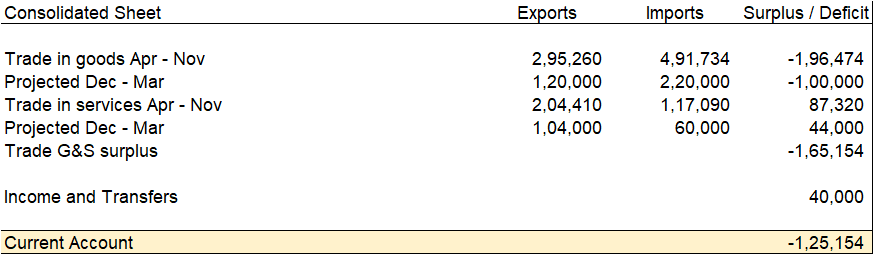

India trade deficit* in November improved to $ 24 bn on a 7% mom growth in merchandise exports to $ 32 bn and de-growth of 1% in mom imports to $ 56 bn. Electronic exports rose sharply while textiles, chemicals and other categories showed contraction. The table below shows Apr - Nov actuals and projected numbers for the FY. This will be the largest current account deficit posted by India.

For Dec - Mar numbers, exports are assumed at $ 30 bn. If the global recession fears materialize on aggressive tightening by Central Banks, the extent of demand destruction in the export basket will need to be closely watched especially since the Indian currency continues to be overvalued. The trade weighed REER index eased from 103.06 to 101.62 in Oct. Assuming a 10% destruction in exports, the export number for balance of the year is estimated at $ 108 bn. On the import side, $ 55 bn of imports per month is assumed. Savings of $ 1 - $1.2 bn are likely to accrue on a 10% reduction in prices of crude oil. Oct crude oil prices averaged b/w $ 92 - $ 93 per barrel and Nov crude oil prices averaged $ 88 per barrel ( for Dec imports). if there is a 20% reduction in crude oil prices, we are looking at $ 6bn of conservative savings on the oil import bill. The above numbers put in perspective how the trade account could worsen. Obviously, this is a very one sided view and other items should be analyzed too but i reckon this gives an estimate.

The current account deficit could be b/w 3.3%-3.60%.

*The data has been approximated for ease of synthesizing.

Comments

Post a Comment