Tensions in the Middle East dominate Risk sentiments | DXY has room to the upside to 106.45 - 106.75 levels| Core PCE Est are for a reading of 0.27% mom| Rate cut bets pushed out

Geopolitical Tensions further escalated as Iran fired drones and missiles over the weekend in response to Israel's attack on the Embassy in Damascus. Israel successfully defended the attacks with the support of the allies with no casualties or damage. Of course, post the retaliation, Israel's allies have come to it's support and are trying to contain the situation. Tweet from the official account of Iran to U.N says "the matter may be deemed concluded" if Israel deters from a response and warned that U.S must stay away from a conflict between the two nations.

Geopolitical Tensions further escalated as Iran fired drones and missiles over the weekend in response to Israel's attack on the Embassy in Damascus. Israel successfully defended the attacks with the support of the allies with no casualties or damage. Of course, post the retaliation, Israel's allies have come to it's support and are trying to contain the situation. Tweet from the official account of Iran to U.N says "the matter may be deemed concluded" if Israel deters from a response and warned that U.S must stay away from a conflict between the two nations. Price action in Crude Oil prices continues to be muted during Asia Trading hours with crude oil prices trading around Friday's close of $ 90.15 which suggests markets may be discounting a base case of no further retaliation from Israel.

Risk sentiment may continue to be tenuous for the next few days as string of headlines from both sides and Global Powers dominate wires.

Meanwhile, DXY closed the week at 106.00 levels ( 1.83% over the week) and reckon there's still some headroom for the DXY to go higher towards 106.45 - 106.75 levels.

Over the last week, the PPI release showed prices rose 0.15% mom. PPI for Final Demand Services rose 0.28% mom. Trend in Services Prices shows sticky inflation across both the CPI and PPI indices.

Post the release of the PPI, the estimates of PCE numbers have been released with median f/c for headline PCE at 0.29% mom and Core PCE at 0.27%. Estimates for Core PCE excl housing are at 0.18% mom.

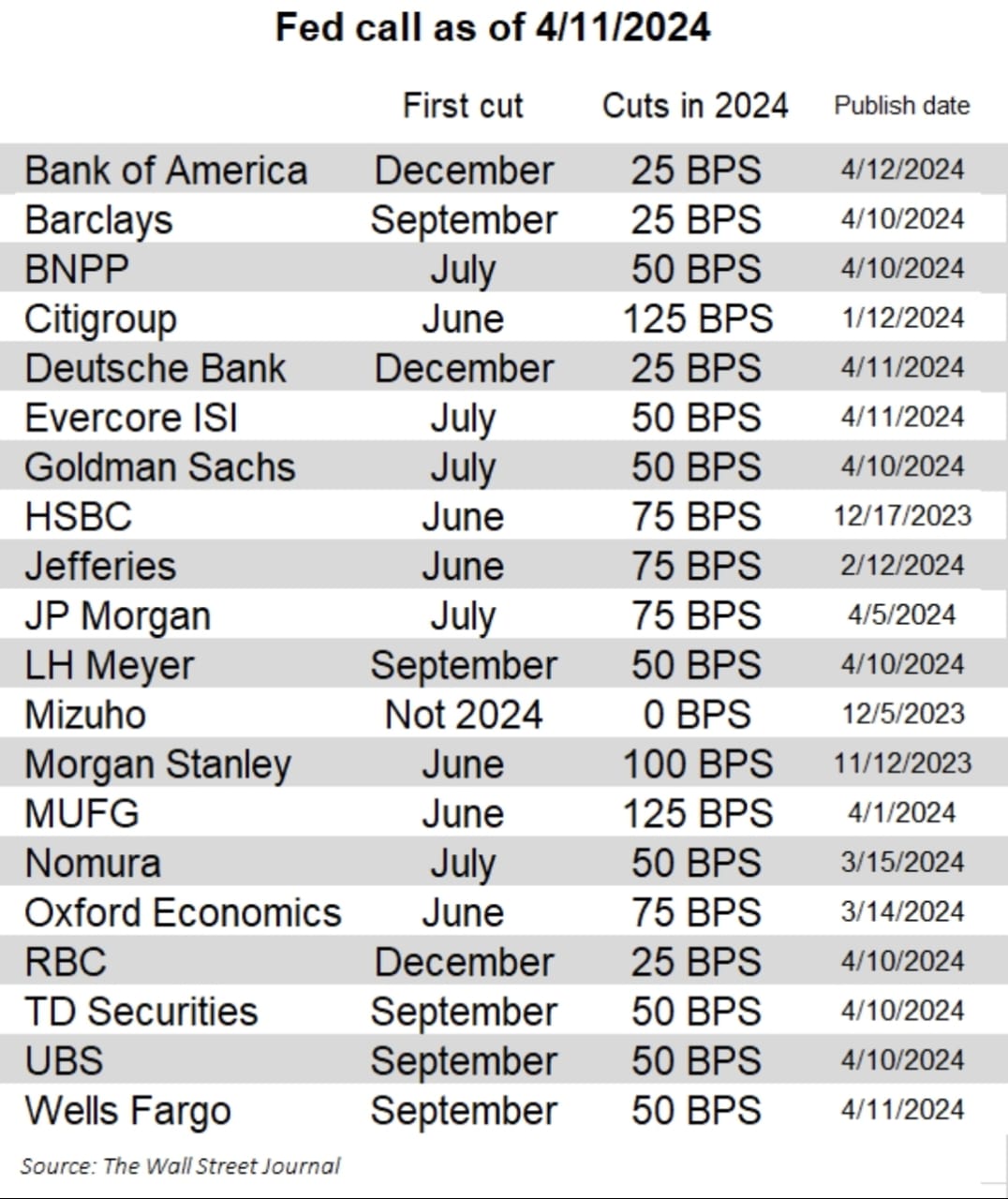

Rate cut bets have been further pushed out and magnitude of cuts has seen revision. From a consensus call as on 02 Apr 2024 of first cuts in June to now only 6 Sell side banks expecting first rate cuts to materialize in June, there has been a considerable pivot in expectations. The strength of economic data - NFP, Mfg PMI, CPI, Jobless Claims and the commodity price rally have been the contributing factors to the Pivot. Atlanta Fed GDPNow estimates Q1 GDP growth at 2.40%.

Comments

Post a Comment