PMI data released overnight showed better reading than estimates across Services and Composite PMI from Italy, France, Germany, EZ and UK. For the US, Services PMI rose to 52.70 with the employment component showing strength. The prices paid and new order component maintained the momentum from last month.

Oct U.S JOLTS data showed Job openings came in at 8.733 mn, the lowest since April 2021.

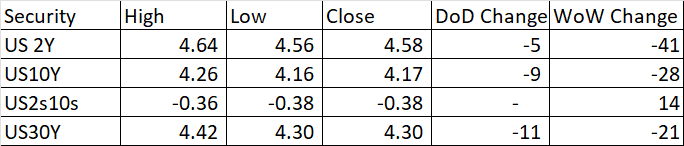

The UST curve rallied with long end of the curve outperforming the short end of the curve.

For U.K. Retail Sales rose 2.60% yoy in Nov.

For Japan, CPI rose at 2.60% yoy (prior 3.2%), excl food and energy rose 3.60% yoy (prior 3.80%), excl fresh food rose 2.30% yoy (prior 2.70%). S. Korea also confirmed the lower inflation trend with mom CPI at -0.60% mom (prev 0.30%) and 3.30% yoy (prior 3.80%). S. Korea GDP grew in line with est at 1.40% yoy. Singapore Retails Sales contracted 0.10% yoy in Oct from previous 0.80% growth. For China Caxin Services PMI also came in stronger than previous reading at 51.50.

Interest Rates were kept unchanged in Australia at 4.35% and echoed Fed's narrative on path to monetary policy centered on data dependence and evolving assessment of risks. The implied Dec 2024 rate is at 4% which implies 35 bps of rate cut. From Monday's high of 0.6691, AUDUSD fell to 0.6544 but was bought back today as Q3 GDP rose 2.10% yoy following a prior reading of 2.10%.

Overall the last 2 days have seen a sharp rally in Bitcoin (~ 14%) plus USD index (0.74%) and strong declines in Brent Crude Oil prices (-2.60%) and Gold (2.50%).

For the day ahead, we have the ADP employment change , Non Farm productivity and Unit Labor Costs for the US. German Factory orders and EZ Retail Sales and Bank of Canada Rate Decision.

Comments

Post a Comment