Release of the US CPI / Repricing of interest rate expectations and a broad based rally across asset classes

The Release :

December CPI -0.1% (Exp 0.0%); Core CPI 0.3% (exp 0.3%); Prior 0.2%. The index for gasoline was by far the largest contributor to the monthly all items decrease, more than offsetting increases in shelter indexes. The shelter index continued to increase, rising 0.8 percent over the month. The rent index rose 0.8 percent over the month, and the owners' equivalent rent index also rose 0.8 percent. The index for lodging away from home increased 1.5 percent in December, after falling 0.7 percent in November.

Small note for those who may have missed why the calculation methodologies of the shelter component of the CPI make it a lagging indicator:

Shelter inflation is a major driver of the CPI index. Housing represents about a third of the value of the baskets of goods that the Bureau of Labor Statistics (BLS) examines when preparing the Consumer Price Index. For renters, shelter inflation measures both rent and utility payments. For homeowners, the BLS calculates imputed rent, what it would cost to rent a similar house. It is calculated using a subset of the same rental data as the CPI: Rent index, weighted by the price that homeowners think their home (unfurnished and without utilities) can be rented for monthly. The CPI for “shelter” has historically lagged home price changes by four quarters, which suggests that shelter “will continue to put upward pressure on overall inflation through the first half of 2023”. The lag effect is largely due to how long it takes for leases to roll over into a new contract. Landlords typically renew leases every 12 months, which means current price dynamics won’t be reflected in new contracts for a year.

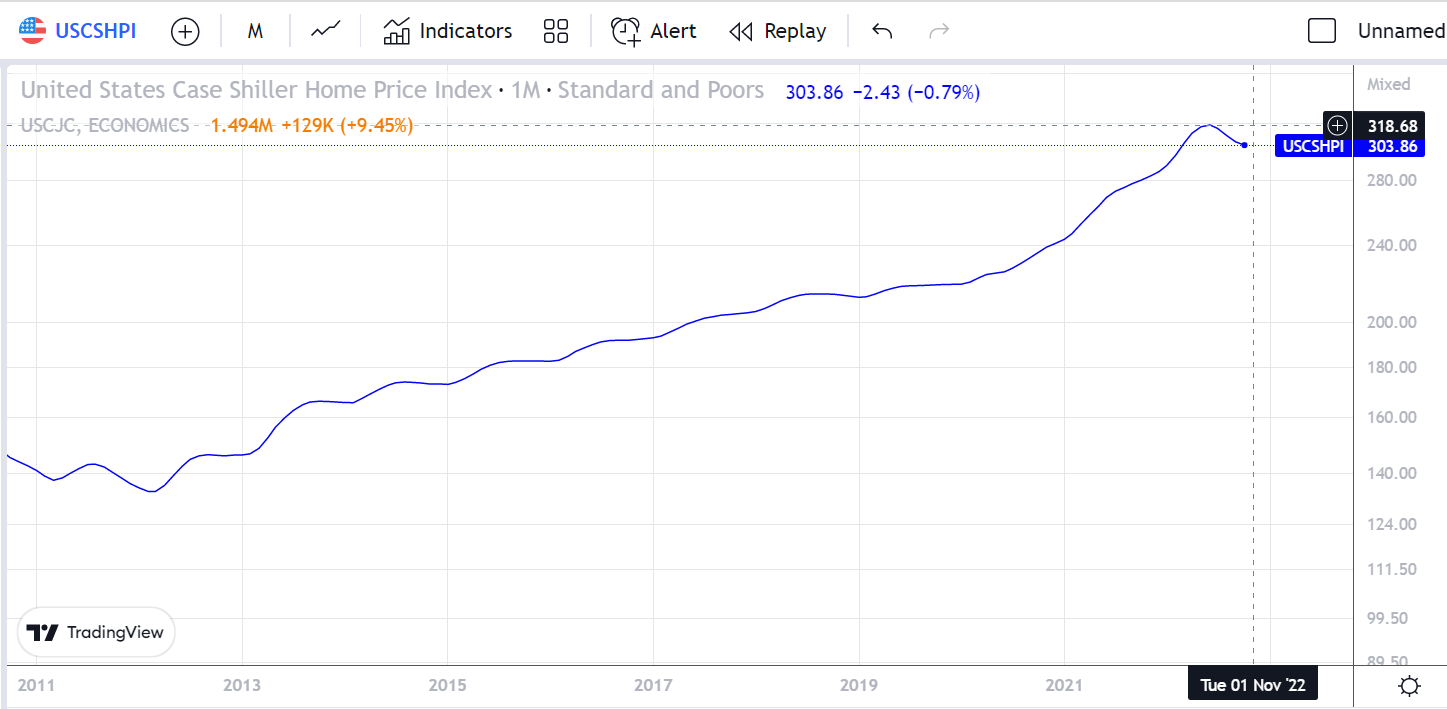

The Case Shiller Home price index suggests deceleration in the CPI component going forward.

Comments

Post a Comment