With my view over the last week on reversal in USD index, it was frustrating to see the moves not playing out on the Dollar Index. Geopolitical Risks were underpriced and Chinese Stimulus (both monetary and fiscal) ahead of the Golden week kept pushing asset prices higher and AUD was the clear beneficiary. Japan Election results also jolted the USDJPY due to PM Ishiba hawkish leanings. For most of the currencies and bond yields, we went no where and closed the week in the middle of the week's range. I could not complete the post yesterday so writing today.

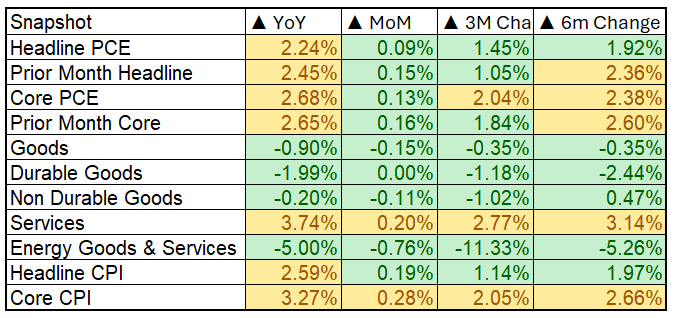

Let's do a quick snapshot of the Economic Data releases this past week.

Atlanta Fed GDP is now trending at 3.10% for Q3 and Fed Funds Pricing show an 82% probability of 200 bps of rate cuts i.e. 2.75% - 3.00% by Oct 2025. As of Friday's close, Markets are pricing in a 92% probability of 75 bps cuts by Dec 2024 but are largely seen divided b/w a 25 bps or a 50 bps cut in the next policy. An important thing to note is that the next policy is right after the U.S. Election. As of now, 22:45hrs (30 Sep), the interest rate cuts have been further priced out with 58% probability of a 25 bps cut and 64% probability of 200 bps of cuts by Oct 2025.

This week's inflation prints showed further progress on Fed's inflation mandate driven by a decline in prices of Goods and Energy. For the Sep readings, Cleveland Fed Inflation Nowcast estimates for Sep are running at 0.11% on headline and 0.27% on Core PCE estimates which translates to 2% yoy and 2.63% yoy respectively.

TThe IJCs and CJCs are holding up pretty steady do not paint a picture of deteriorating Employment situation in the US.

The Durable Goods data came in better than consensus expectations.

Governor Bowman's Speech highlighted why she favored a 25 bps cut - concerns that a 50 bps cut would signal fragility to the Economic Outlook, expectations setting on the future path of rate cuts and considerable amount of pent-up demand and cash on the sidelines which is ready to be deployed as the path of rates moves down and the consequent loosening in financial conditions could upend the Fed reaching its objective on Inflation.

With regards to employment data, she noted labor market continues to be near estimates of full employment from a historical standpoint and that the recent data does has not been consistent with material Economic weakening which has also been repeatedly emphasized in this blog. An interesting point she makes is "My contacts also continue to mention that they are not planning layoffs and continue to have difficulty hiring." She also mentions "recent immigration flows have and will continue to affect labor markets in ways that we do not yet fully understand and cannot yet accurately measure." She advocated a gradual recalibration to policy.

This week is a Employment Heavy Week with Fed's focus front and center on Employment in light of the progress on inflation, keep a close out on the JOLTS data - slowdown in hiring activity, layoffs rate. Moving forward, the most crucial data piece will be the NFP where expectations are for a reading of 140K and U/R at 4.20%.

I continue to expect a reversal on the DXY and playing accordingly with EURUSD being the favored currency to express long USD view.

Comments

Post a Comment